Conversational AI in insurance can be a blessing not only for the service providers but also for the customers. It can resolve the age-old issue of bad user experience.

Most customers fall back or switch to another insurance service due to lengthy wait times, unanswered queries, claim issues, etc. But with the help of conversational AI and chatbots, customers can be served well. They will get their queries answered and issues resolved in minimal time. And human representatives will have enough time to handle more important tasks.

Conversational AI can automate most of the insurance industry conversations, which translates to speedy growth of the business and happy customers. But how does it work? That’s what we are going to unveil in this article.

Part 1: What's Conversational AI?

Conversational AI refers to the specific use of Artificial Intelligence to understand and process human languages and generate appropriate responses. It involves Natural Language Processing (NLP) and Machine Learning (ML) to simulate human conversations.

NLP helps in understanding and processing human languages, while ML makes the system capable of learning and improving on its own. After incorporating these technologies, the system is trained on massive real data.

Usually, conversational AI refers to AI chatbots, virtual assistants, and similar technologies that are capable of having conversations with humans. They can automate various redundant tasks, handle customer queries, and improve the overall customer/user experience.

Part 2: How Conversational AI Works for Insurance?

Conversational AI for Insurance means adaptation of the technology in the insurance industry.

Let’s say a customer wants to inquire about the health insurance plan and learn about its key benefits. A conversational AI chatbot can handle this task and guide the customer without any wait time. The customer will get the queries answered and may ask further questions. No human intervention is needed for simple issues.

Chatbots can handle most of the customer questions, complaints, and issues. They can reduce the work of human representatives and help improve customer experience. If they can’t answer any specific query or there is something of their domain, they can escalate the issue to the relevant human representative.

Part 3: Benefits of Using Conversational AI for Insurance

Conversation AI for insurance is a necessity to be ahead of competitors, improve customer experience, and keep the business thriving. Here’s what it generously offers.

- No Waiting Time: Customers no longer need to wait for their queries to be answered and complaints to be processed. Chatbots can handle them faster with minimal wait. They work 24/7 and respond in multiple languages.

- Automation: Chatbots automate redundant tasks, such as answering simple queries and collecting data. They save the previous time of CSRs and allow them to work on more productive tasks.

- Risk Assessment: The risk assessment capability of well-trained chatbots is much better. It mitigates the chances of errors and helps in assessing the risk in almost no time. That said, more customers can be severed, which means more revenue.

- Fraud Detection: Fraudulent claims are a headache for insurance companies, and chatbots can detect them easily and quickly. They can authenticate the issue and identify fraud by identifying the common patterns and tactics.

- Cost-Saving: Chatbots reduce the operation cost of the business. They handle most of the queries, so fewer CSRs will be needed.

Part 4: 5 Use Cases of Conversational AI for Insurance

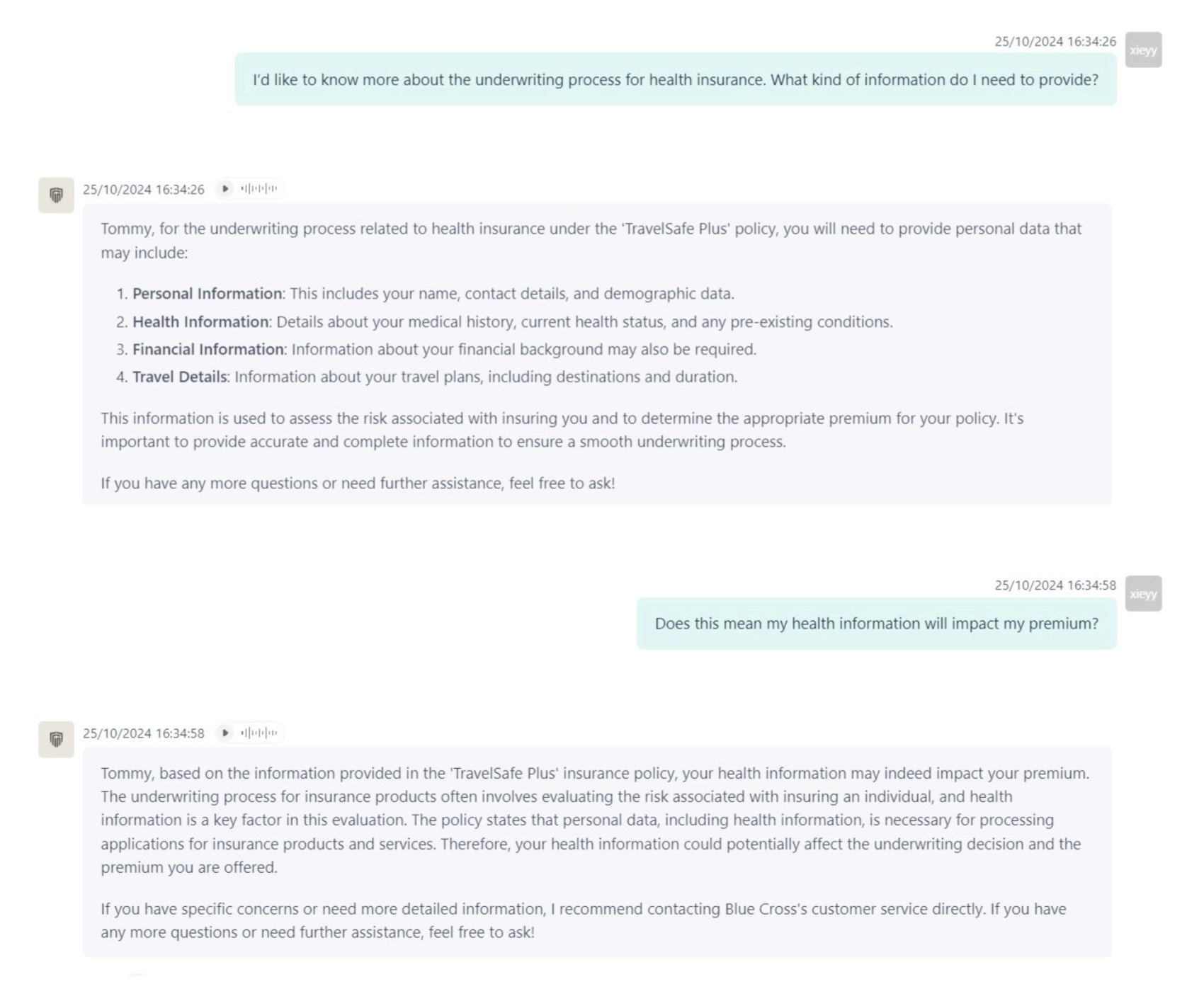

1 AI in Insurance Underwriting

Insurance underwriting is a time-consuming process. Insurance experts need to calculate the applicant’s risk before issuing a policy. They evaluate the applicant on different factors and decide whether the customer is eligible for the policy or not. Secondly, they calculate the risk involved and the right plan for the person.

All these hectic tasks can be handled by AI chatbots. They collect data from the customers and complete the process of insurance underwriting. They evaluate the applicant based on the decided factors. It makes the process quicker and reduces the chances of errors.

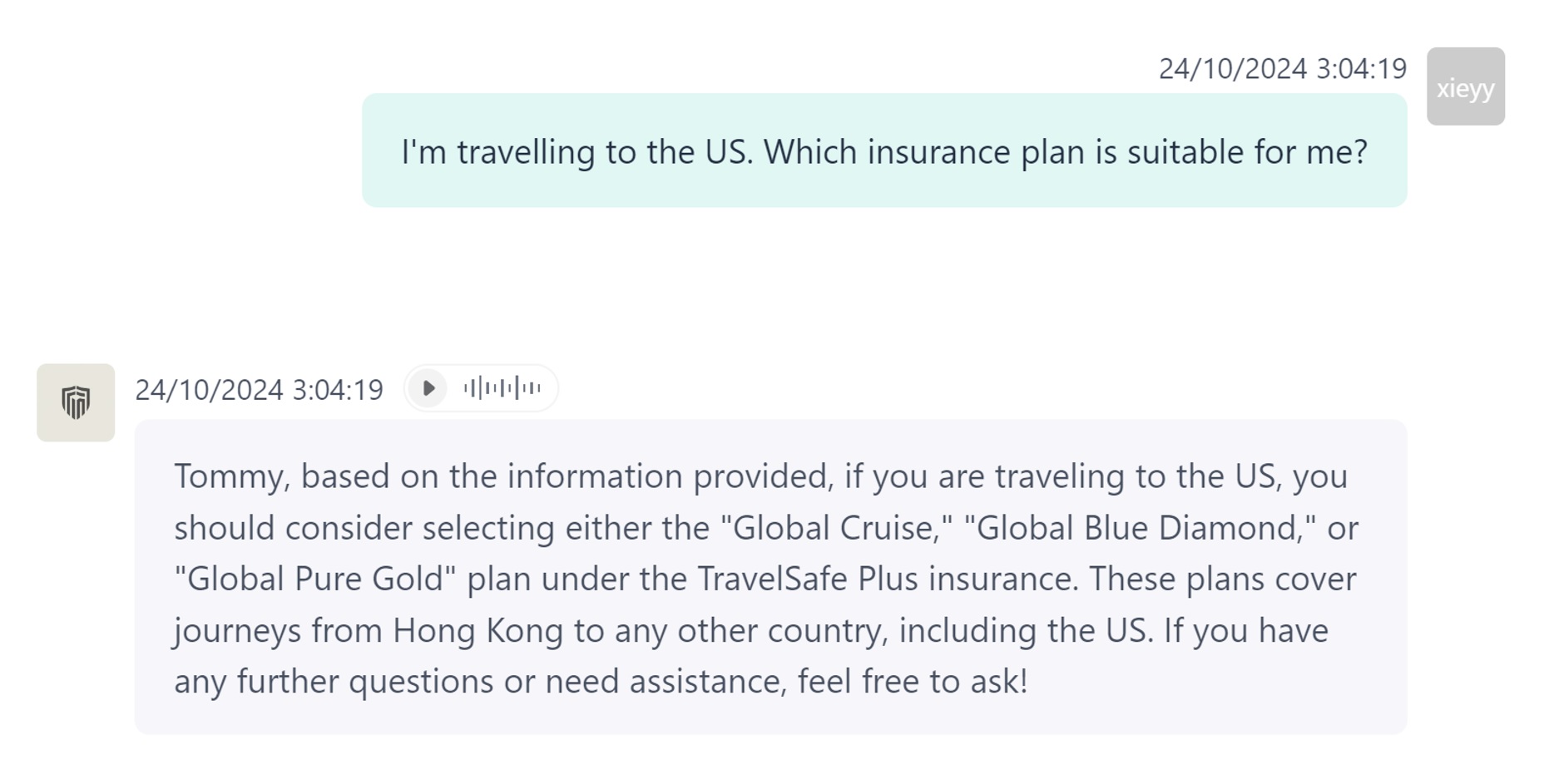

✅ Here’s an AI chatbot suggesting the right insurance plan to the customer based on the provided information.

Conversational AI in insurance underwriting

2 Customer Service

Customer service representatives (CSRs) have limited time to deal with customers. If they give excessive time to a customer, the wait time for other customers will be longer. And if they try to wrap up the conversation quickly, the customer will be left unsatisfied. In short, CSRs can’t handle all customer queries alone, and that’s where customer service chatbots come into play.

These bots handle common customer queries and questions. For instance, if the customer is here for an inquiry, they can answer through their knowledge base. There is no need for human intervention, and most of the queries are handled by chatbots, resulting in time-saving for CSRs.

✅ Here’s how a customer service bot answers insurance queries.

Conversational AI in customer service for insurance

3 Claims Processing

Policyholders often struggle with claim processing, and that’s a never-ending issue. The process requires time to evaluate eligibility, but customers need the amount as soon as possible to cover their loss.

An AI chatbot is capable of making the claim process faster, hassle-free, and more pleasant. Firstly, it collects the required documents and details from the customers. Then, it calculates the appropriate amount for the claim based on the company’s criteria. It reduces human involvement and makes the process quite fast, which makes customers happy. Most importantly, they detect fraud quickly and reduce the company’s expenses.

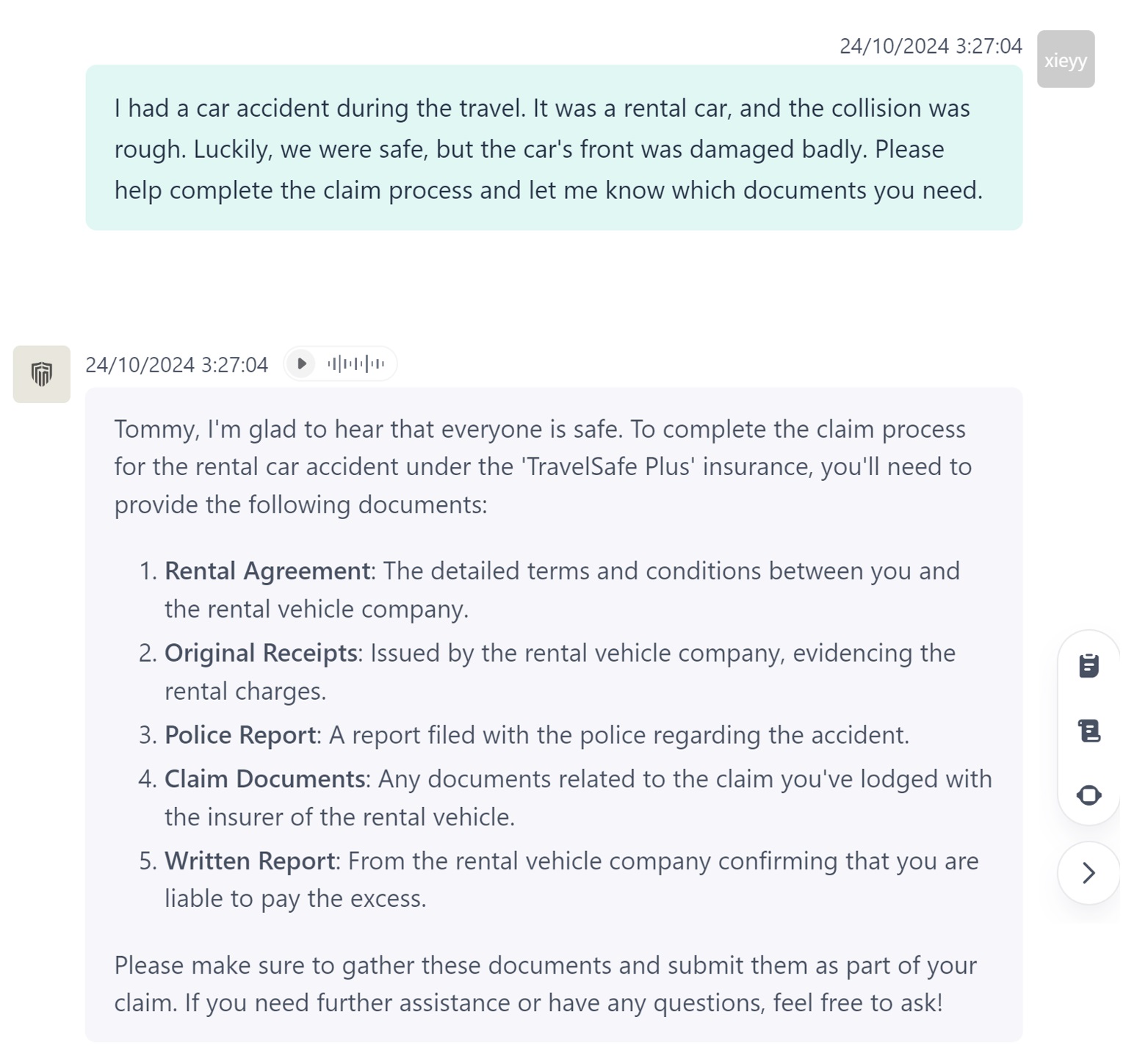

✅ Here’s how a chatbot processes a customer’s claim.

Conversational AI in claims processing

4 Automate Redundant Queries

In the insurance industry, CSRs receive too many redundant queries that waste a lot of their time. It prevents them from focusing on potential clients and the tasks that actually matter.

For instance, almost all customers ask about the types of insurance policies that the company offers. Then, the questions related to the coverage amount, age, and criteria are extremely common.

All these redundant queries can be automated using an AI chatbot. These simple questions do not require human intervention and can be answered by chatbot by learning through the given knowledge base.

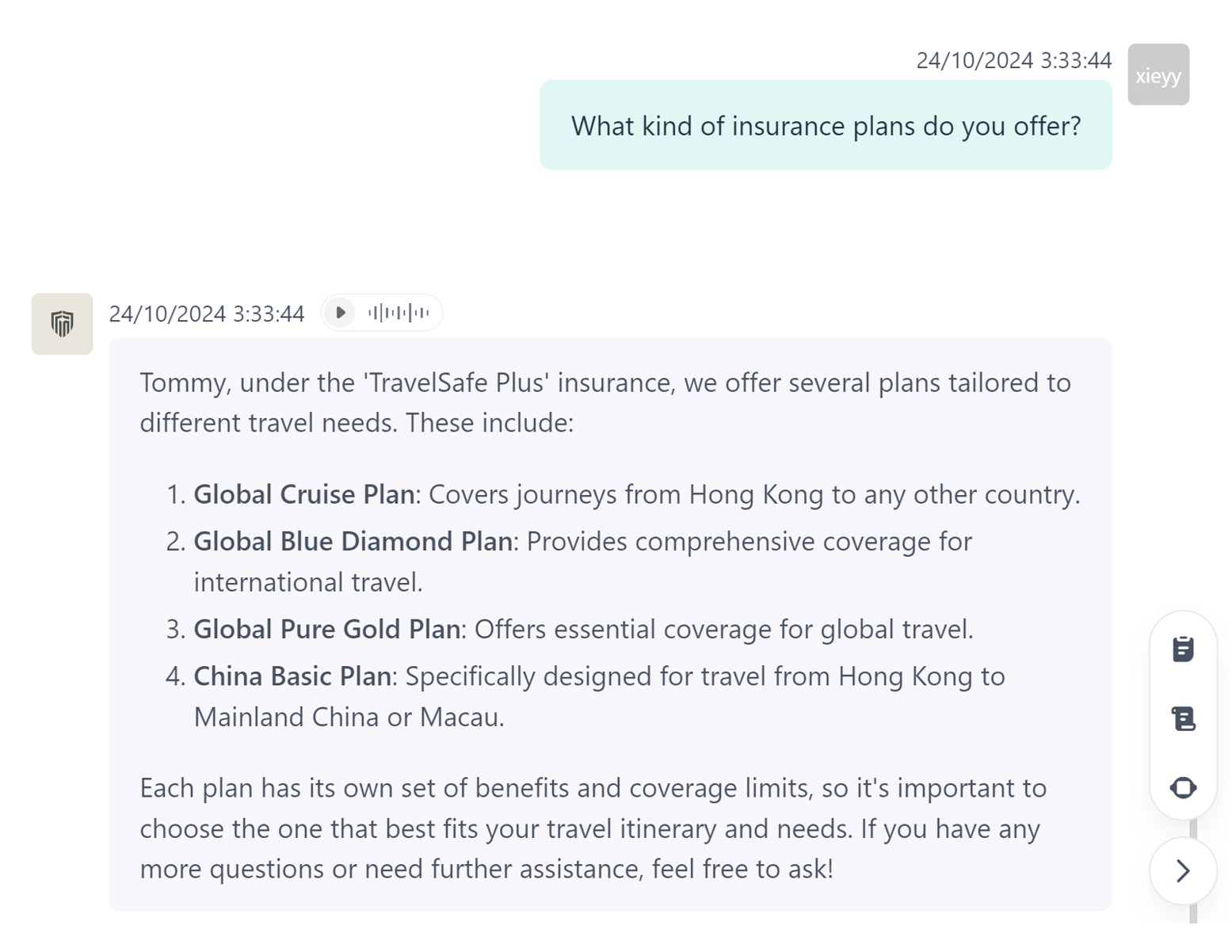

✅ Let’s see an example of an insurance chatbot answering redundant queries.

Conversational AI in redundant insurance queries automation

5 Sales and Marketing

Insurance chatbots have the potential to increase the sales of businesses. They understand the needs of the customers and offer them personalized recommendations, such as the insurance policy they are looking for. They also succeed in convincing customers and generating qualified leads.

But that’s not it. They also recommend additional policies and benefits, which is called up-selling. It ultimately increases the revenue of the business.

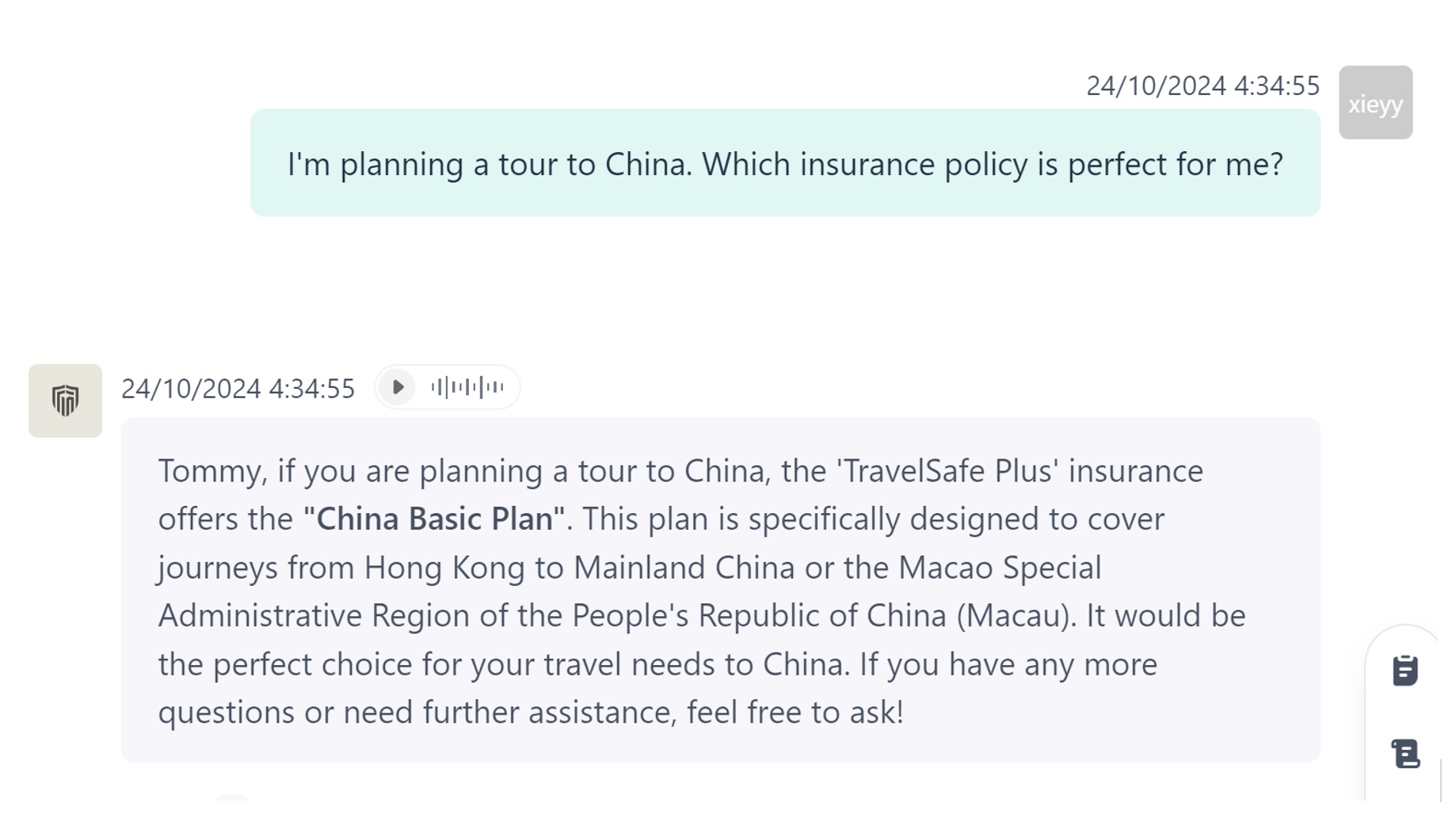

✅ Here’s an insurance chatbot recommending an insurance policy to a customer.

Conversational AI in insurance sales

Part 5: Implement Conversational AI in Your Insurance Business

Conversational AI in insurance is quite beneficial, and it’s evident from the use cases and examples we have seen. Conversational AI provides instant response and personalized help, enhancing customer interaction and streamlining operations. By providing fast policy information, claims processing and 24/7 support, it effectively improves the customer experience. It enables insurance companies to reduce response times and improve customer satisfaction while also helping them analyze data and trends to make better decisions and customize products.

Aren't these benefits attractive? You can build or customize a conversation AI insurance chatbot according to your business. And it does not require any coding or prior experience.

GPTBots, provider of AI solutions for business , empowers you to create any kind of chatbot in a few minutes without coding. The chatbots we've seen in the above examples were all built using GPTBots.

Key Solutions Provided by GPTBots AI Agent Platform:

- Customer Support : Automates up to 90% of customer inquiries, reducing operational costs by up to 70% while providing 24/7 multilingual support.

- AI SDR (Sales Development Representative) : Enhances lead generation and qualification, boosting conversion rates efficiently.

- Enterprise Search : Empowers employees to quickly retrieve critical information from vast knowledge bases.

- Data Insights : Delivers real-time analytics and actionable insights to optimize business decisions and strategies.

Integrating an enterprise knowledge base, updating responses to customers based on the latest data, supporting more than 90 languages, providing multimedia responses (e.g., pictures, videos, maps), GPTBots help businesses increase efficiency, improve customer experience, and drive growth across multiple platforms, languages, and time zones.

With GPTBots.ai's expert support, you can quickly and easily build insurance AI chatbots tailored to your specific needs.

Part 6: FAQs on Conversational AI Insurance Agent

1 How is AI being used in the insurance industry?

AI is being used in the insurance industry for customer service, handling claims, fraud detection, underwriting, analytics, marketing, automation, etc.

2 How does a conversational AI insurance chatbot work?

A conversational AI insurance chatbot first understands human language through NLP, and then it processes it. After that, a response is generated based on the knowledge base provided and the training. Over time, it improves through more data in the knowledge base and machine learning.

3 Will AI insurance agents replace human agents?

AI insurance bots cannot replace human agents. They are built to assist them in handling customer queries, redundant tasks, etc. They save their time for more important tasks, and if they can’t answer any query or solve any issue, they direct the customer to a human agent.

Conclusion

In short, AI is transforming the insurance industry. By providing instant responses and automating repetitive tasks, Conversational AI significantly improve the customer experience, reducing wait times and ensuring timely resolution of queries. In addition, they assist with critical processes such as underwriting and claims management, enabling insurers to operate more efficiently and detect fraud more effectively. As we explore the various use cases and benefits of this technology, it's clear that conversational AI is no longer just an option, but a necessity for insurance companies aiming to thrive in a competitive environment.

If you're looking for an AI tool that not only solves most user queries but also helps you better gather user needs and feedback to make better business decisions, then GPTBots is the way to go.