In recent years, the financial services industry has witnessed a significant transformation and emerges as one of the top 5 sectors benefiting from the implementation of chatbots and artificial intelligence (AI). The COVID-19 pandemic accelerated this trend, with approximately 2/3 of global financial service providers integrating chatbots into their applications to enhance customer support.

As consumers increasingly turned to digital solutions for their financial needs, chatbots have become essential tools for improving user experience and streamlining service delivery. Here we will try to explore the concept of a finance AI chatbot in detail and discuss various use cases where AI chatbots are reshaping finance and banking. In addition we will also guide you on how to build a finance AI chatbot free tailored for banks and personal finance applications using the most convenient solution available today.

Part 1: What Is a Finance Chatbot?

A finance chatbot is an AI-powered virtual assistant designed to interact with customers and provide banking or financial services through conversational interfaces. By using artificial intelligence and natural language processing (NLP), finance chatbots can assist customers 24/7, provide answers to frequently asked questions, process transactions, and deliver personalized financial insights. These bots are transforming the way banks and financial institutions engage with their customers by improving response times and reducing the need for human intervention. With the increasing adoption of AI in banking, the use of AI chatbot for finance has become crucial for enhancing customer satisfaction and operational efficiency.

Types of Finance AI Chatbots in Banking

In the banking sector, finance AI chatbots can be broadly categorized based on their functionalities and the nature of services they provide. While there may be various specialized roles, most finance chatbots can be classified into three main types:

1Informational Chatbots

Informational chatbots are the most basic type, designed to provide quick, accurate responses to common customer inquiries. For example, they can answer questions about account balances, branch locations, banking hours, or the status of transactions. These chatbots act as a first line of support, reducing the need for customers to navigate lengthy phone menus or search for information manually. Although these chatbots focus mainly on sharing information, they help save time and improve customer experience by offering real-time assistance.

2Action-Oriented Chatbots

Action-oriented chatbots take the functionality of informational chatbots a step further by enabling customers to perform various transactions directly through the chatbot interface. Whether it's transferring funds, paying bills, or setting up recurring payments, these chatbots facilitate secure hands-on banking operations. Their ability to process transactions in real time makes them indispensable for streamlining everyday banking tasks. Banks are increasingly adopting this type of AI chatbot for finance to reduce customer reliance on mobile apps or websites.

3Advisory Chatbots

Advisory chatbots are more advanced and use sophisticated algorithms to offer personalized financial advice based on the customer's transaction history, spending patterns, and long-term goals. These bots can provide tailored recommendations such as suggesting savings plans, investment options, or helping customers manage their budgets. The advisory finance AI bot role extends beyond merely answering queries; it acts as a virtual financial advisor helping users make informed decisions about their money. While they don't replace human financial advisors for complex decisions, these chatbots can support customers in managing their day-to-day finances with greater ease.

Part 2: Use Cases of AI Chatbot for Finance and Banking

As financial institutions increasingly shift towards digital solutions, the implementation of chatbots has become a game-changer in 2024. Finance AI chatbots are not just tools for automation; they are becoming integral to enhancing customer experience and optimizing operations. Let's explore some compelling use cases for AI chatbots in finance and banking along with real-time interaction examples.

1Improving Customer Service

To stand out in the competitive world of finance, providing exceptional customer service is vital for differentiating oneself and fostering strong connections with clients. Unlike traditional customer service methods, which often involve long wait times, an AI chatbot for finance transforms customer service by offering 24/7 support and handling a wide range of tasks instantly. From checking balances and paying bills to troubleshooting technical issues and updating contact information, AI chatbots are redefining what customer service can offer in finance.

For instance, Bank of America’s Erica chatbot demonstrates the real-world impact of a finance AI bot. Erica not only provides customers with transaction histories but can also notify users about upcoming bills, remind them of low balances, and offer personalized advice based on their banking behavior. By integrating customer data, chatbots like Erica ensure faster resolutions, reduced wait times, and a more personalized experience for each user.

2Simplifying Expense Tracking

Another vital use case for an AI-based finance bot is expense tracking. Managing personal finances and budgeting has traditionally been a manual and time-consuming process, but chatbots have simplified this task. Users can now easily track their spending habits, categorize expenses, and even receive notifications when they exceed their set budgets.

Here's how a typical interaction with such finance chatbots looks like:

With capabilities to create expense reports, submit missing expenses, and add transactions, chatbots streamline the financial monitoring process. This won't only help users track their spending more accurately but also free up financial agents to focus on more complex inquiries.

3Providing Personalized Financial Advice

While human financial advisors are still essential for complex planning, AI chatbots are increasingly taking on the role of offering general financial advice. A finance AI chatbot can answer common questions about savings, investments, and personal finances based on the user's specific financial situation. These bots analyze spending patterns, income, and goals to deliver personalized suggestions that help users manage their money more efficiently.

A notable example is Buffet, the chatbot by Talkbank, named after the famous investor Warren Buffett. Buffet can answer frequently asked questions about accounts and bills, while directing customers to human experts for more tailored advice.

4Seamless Lead Generation and Onboarding

If you're working in the finance industry, you likely understand how critical it is to not only attract new customers but also to ensure their onboarding process is seamless and efficient. A smooth and engaging onboarding experience can significantly enhance customer satisfaction and loyalty, which are key to long-term success in such a competitive field. And this is exactly where an AI chatbot for finance excels, acting as a virtual assistant that guides potential clients through the onboarding process while also gathering critical information for lead generation.

An AI-powered finance bot can engage users by asking relevant questions about their financial needs, such as their income, investment goals, or risk tolerance. These chatbots pre-qualify leads and provide sales teams with valuable information that can help tailor products to each customer.

For instance, a chatbot might ask:

Chatbot: “What are you looking for in a savings account?

Higher interest rates, easy withdrawals, or both?”

User: “I'm looking for high interest rates.”

Chatbot: “We offer a savings account with a 3.5% annual

interest rate. Would you like to learn more or start the application

process?

In addition to generating leads, chatbots streamline the onboarding process. Instead of requiring customers to visit a branch or fill out long forms, the finance bot can walk users through each step, answer questions in real time, and even help them upload necessary documents. This results in a smoother user experience, less time spent on manual processes, and higher conversion rates as potential customers are more likely to complete the onboarding.

5Preventing Fraud and Suspicious Activities

In the financial sector, fraud prevention is a top priority, and AI chatbots play a crucial role in safeguarding customer accounts. With advanced algorithms, an AI chatbot for finance can continuously monitor account activity and flag any suspicious behavior in real time, offering a layer of protection that enhances data security.

For example, if a finance bot detects an unusual transaction, such as a large withdrawal from an unfamiliar location, it can immediately notify both the customer and the bank's fraud prevention team.

With the ability to monitor large volumes of data in real time, finance bots can quickly identify irregular patterns, such as multiple failed login attempts or unauthorized account access. This proactive approach helps prevent potential fraud before significant damage can occur, providing peace of mind to customers and reinforcing trust in the bank.

Part 3: What Are the Benefits of a Financial Chatbot?

-

24/7 Instant Support

A financial chatbot offers round-the-clock assistance, allowing users to check balances, track transactions, or ask account-related questions anytime. This ensures users aren't limited by business hours and reduces dependency on traditional customer service channels. -

Automates Routine Transactions

Users can quickly complete tasks like transferring funds, paying bills, or updating contact information without human assistance. This speeds up processing, minimizes manual errors, and frees up customer service agents to focus on more complex issues. -

Reduces Customer Service Costs

By handling high volumes of repetitive queries, chatbots cut down on operational costs. Banks and financial platforms can serve more users with fewer agents, lowering expenses without compromising service quality or response speed. -

Delivers Personalized Financial Insights

Using account history and customer data, the chatbot can provide tailored advice—like spending summaries, savings reminders, or product recommendations. This creates a more engaging experience and builds trust with users. -

Improves Accuracy and Compliance

Chatbots follow pre-defined workflows and language templates, reducing the risk of misinformation. They help financial institutions deliver consistent, compliant responses, especially when dealing with regulations, disclosures, or sensitive data.

Part 4: How to Build a Financial Chatbot?

After exploring the significant benefits of finance AI chatbots, you might be considering how to implement one in your financial organization. Whether your goal is to increase conversion rates through effective financial services or to enhance the overall customer experience, GPTBots is the solution you need. This no-code bot builder uses the latest AI and machine learning algorithms to allow you to create any type of finance chatbot without requiring technical expertise.

GPTBots comes with a user-friendly and modern interface that makes it easy to navigate and build your chatbot without any technical skills. With GPTBots - Best Finance AI Chatbots Builder, you can easily design and deploy various types of finance AI chatbots tailored to your organization's specific needs.

- Data Analyst Chatbot: This type of chatbot is ideal for generating reports, providing financial insights, and delivering up-to-date market news. It can help users make informed decisions by analyzing data and presenting it in an easy-to-understand format.

- Customer Service Chatbot: A customer service chatbot is essential for handling routine banking queries and offering personalized financial advice. It can answer FAQs, troubleshoot issues, and provide tailored recommendations based on the user's financial situation.

- Mortgage Application Chatbot: This chatbot automates the loan processing workflow by handling application reviews and guiding users through the mortgage approval process. It simplifies what can often be a complex and time-consuming task.

- Personal Finance Advisors: Finance AI chatbots can also act as personal finance advisors and help users manage their budgets, track expenses, and set savings goals. This feature empowers customers to take control of their financial health.

Moreover, the versatility of GPTBots allows you to create a variety of other finance chatbots, each designed to meet specific needs of your organization and customers.

Step-by-Step Guide to Build Finance AI Chatbot with GPTBots

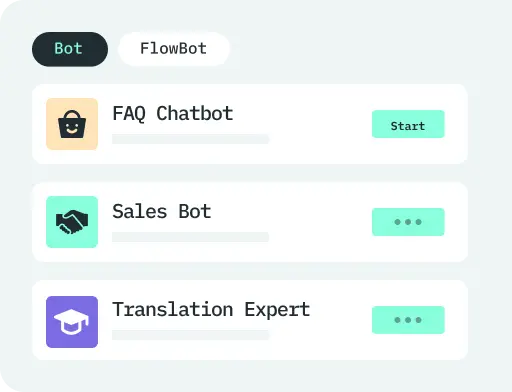

Step 1: Register and Create Your Bot

To build your finance AI chatbot, visit the GPTBots.ai website and sign up for an account. Once logged in, click on “New Bot” to either create from scratch or choose a pre-designed template that suits your needs.

Step 2: Configure Settings

Now, configure the bot's settings, including response length, and clearly define its role and tasks in the “Identity Prompt.”

Step 3: Upload Your Knowledge Base

Next, navigate to the Knowledge section and upload all relevant data to train your bot. You can add files, spreadsheets, website URLs, and FAQs to build a strong knowledge base. After that, go to the “Config” panel and enter “Debug” mode to test the bot's responses. Use the “Train” icon to edit any answers as needed.

Step 4: Test and Train Your Bot

Finally, once you’re satisfied with your bot, head to the “Integrations” panel to publish it on your preferred channels, such as WhatsApp, Discord, or Slack.

Your finance AI chatbot will then be live and ready to assist customers. Plus, you can explore the option to start with a finance AI bot to see how it works for your organization.

Part 5: The Best Finance Chatbots

While we have discussed the best solution to build your finance AI chatbot using GPTBots, which allows for convenient creation of a variety of finance chatbots, you may still wonder if there are other AI chatbots available for finance. In this section, we will explore 5 more finance chatbot builders available in 2024 and highlight their unique features and capabilities.

1. Collect.chat - Visit Here

As its name implies, Collect.chat is designed to gather real-time feedback through engaging conversations with customers. It offers pre-made templates that can be customized to fit your specific business needs. With a simple drag-and-drop interface and intuitive navigation, creating a chatbot is pretty simple and straightforward. Collect.chat claims to boost conversions by three times by effectively collecting leads and data.

Pros

-

User-friendly drag-and-drop interface, no coding needed

-

Provides analytics and data visualization tools

Cons

-

Limited customization options compared to some competitors

-

Pricing can become expensive as features scale

-

May not support complex query handling

Pricing:

Free plan | Lite plan ($24/month) | Standard plan ($49/month) | Plus plan ($99/month)

2. Haptik - Visit Here

Haptik is a smart finance chatbot that excels in budgeting tools and it integrates seamlessly across various platforms, such as websites and messaging apps. Haptik uses natural language processing to understand user queries and offer personalized financial advice. Its budgeting feature helps users manage their finances more effectively by tracking spending and providing alerts.

Pros

-

Strong integration capabilities with multiple platforms

-

Offers smart budgeting tools to assist users

Cons

-

Frequent platform downtime can affect reliability

-

May require time for setup and configuration

-

Some features may not be fully developed

Pricing:

Custom pricing available based on business needs

3. Ultimate.ai - Visit Here

The next option in our list is Ultimate.ai that focuses on chat automation for financial services. It automates customer interactions, handling FAQs, booking appointments, and providing financial advice. The platform is easy to set up and integrates well with existing systems that help businesses reduce operational costs while improving customer satisfaction.

Pros

-

Multilingual support for a global audience

-

Secure and compliant with data protection regulations

Cons

-

Lacks voice support and sentiment analysis features

-

Some bugs and glitches may impact performance

-

Custom pricing can be unclear without a detailed quote

-

Initial setup may require technical expertise

Pricing:

Custom pricing based on specific requirements and usage

4. Kasisto - Visit Here

Kasisto is designed for financial institutions that want to enhance their customer experience through advanced technology. Its finance AI chatbot, KAI, is built to support seamless and personalized banking interactions. KAI can be easily integrated into existing systems and channels, which allows customers to access 24/7 support for various tasks, such as making payments, reviewing account details, and managing funds across multiple accounts using natural language.

Pros

-

Centralized monitoring of digital assistant performance for better insights

-

Omnichannel delivery ensures broader customer coverage

Cons

-

Slower customer support response times

-

A steeper learning curve for new users

Pricing:

Custom pricing based on business requirements

5. AlphaChat - Visit Here

Last but not the least is AlphaChat that widely known for its integration capabilities and ease of use. This finance bot can automate and streamline customer service across various platforms, such as WhatsApp, Facebook Messenger, and Telegram. Users can customize AlphaChat to reflect their brand's identity and tone, which enhances the overall customer experience. The chatbot utilizes natural language processing and machine learning to provide faster and more accurate responses to inquiries about account balances, transaction history, and payment options.

Pros

-

Easy sharing of bot access with colleagues via a ready-made URL

-

Auto prediction of topics for each customer message helps streamline conversations

Cons

-

Higher pricing compared to other chatbot platforms

-

Some integration issues with third-party systems and channels

Pricing:

Starts at $440 per month

Conclusion

Living in 2024, finance AI chatbots are truly reshaping the way financial institutions interact with their clients. We’ve explored the various types of finance AI chatbots and their practical applications in banking by showcasing how they enhance customer service, streamline operations, and provide valuable insights.

While there are many tools available for creating AI chatbots in finance and banking, none can match the control and convenience offered by GPTBots.

Here are some key features that make GPTBots the best solution for your financial needs in 2024:

- Expert-Assisted Custom Bot Building: With expert support, you can quickly and easily build a finance AI chatbot tailored to your specific needs.

- Seamless Integration with Tools and CRMs: Integrate GPTBots with any tools or CRM systems, automating workflows and ensuring your chatbot operates in harmony with your existing financial infrastructure.

- Easy Training Methods: Train your chatbot effectively by simply uploading your own business knowledge base, including websites, PDFs, and other document types.

- Support for Multiple Input Types: Enhance user interactions by allowing your bot to process various input types, such as text, images, videos, and more.

- Versatile Bot Applications: Facilitate the creation of finance chatbots for various purposes, including customer support, lead generation, and employee assistance, to meet your organization’s diverse needs.

As the landscape of finance continues to evolve, adopting a Finance AI chatbot like GPTBots can give your institution a significant edge in delivering exceptional service and maintaining strong customer relationships.